Why is a Colorado-based asset manager at the forefront of the effort to bring more American investment capital to Israeli markets? IIA Co-Founder and Portfolio Manager Brian Friedman recently granted an extensive interview to Israeli journalist Yafit Ovadia to explain. Brian told Ovadia all about his own journey toward understanding Israel’s economic potential, explains why Israel has been overlooked as an investment target, offers some global economic predictions, and cites investing in Israel as a way to counter the divestment advocated by BDS activists.

Several members of our team spent 10 days in Israel earlier this month. We wanted to see the Israel we invest in, the facts-on-the-ground Israel. Executives from several of the companies in our portfolio showed us how ready their firms are to become even bigger players on the world economic stage. We are planning a similar trip this fall for current and prospective clients; prepare to be inspired.

At one of IIA’s recent Hatzlacha events, our panelists discussed how career, philanthropy, and personal life can all mesh when you are doing something you believe in. IIA’s own Amy Kaufman is an example of this, as is apparent from her recent guest appearance on the Positive Impact Philanthropy podcast.

During his first visit to Israel in 1984, a teenage Brian Friedman couldn’t help but notice two things. One was the dynamic, vibrant, enterprising spirit of the Israeli people. The other was the plummeting of the shekel, which seemed to lose half its value during the six weeks of Brian’s tour.

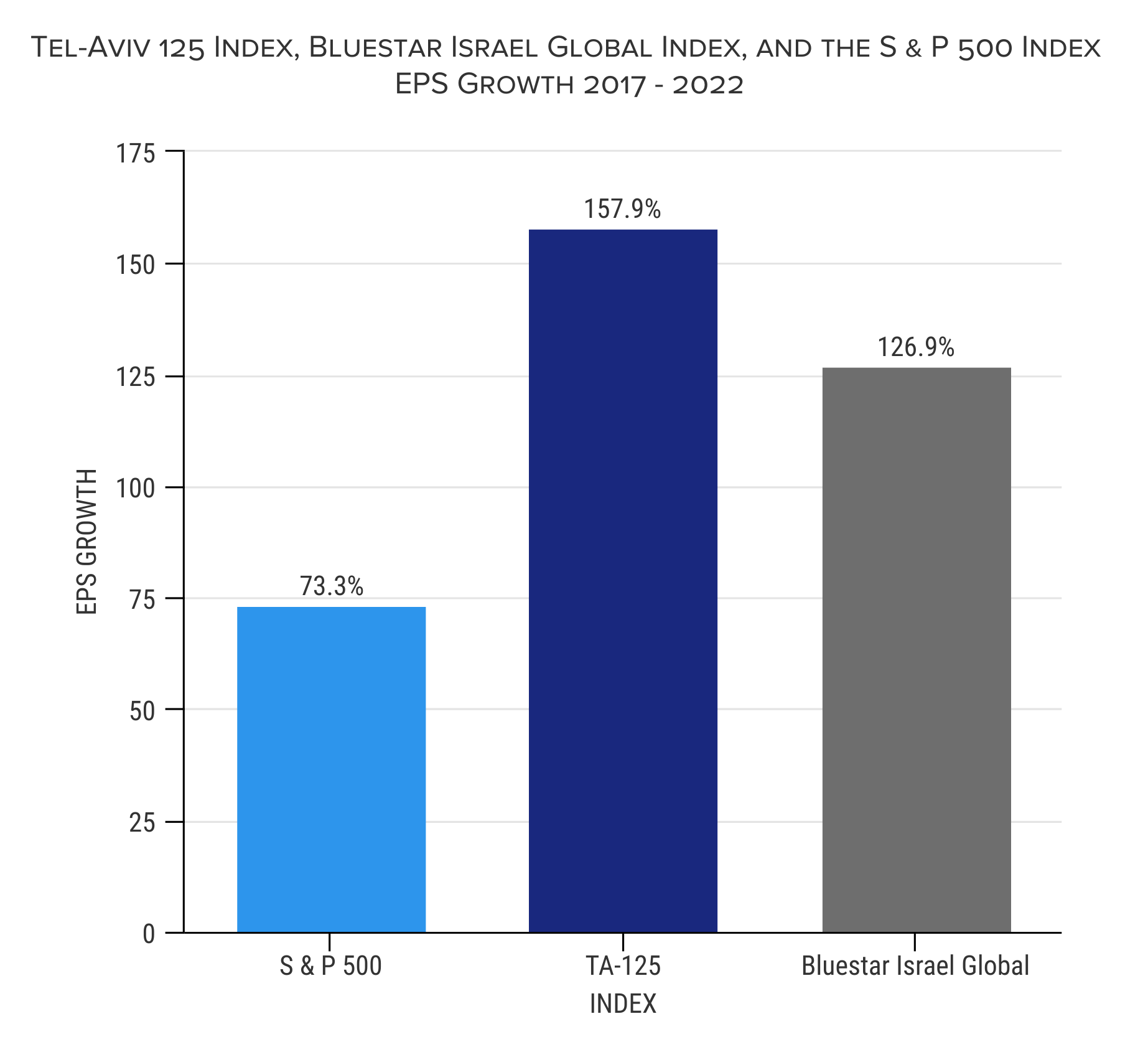

If American investors are missing out on opportunities on the Tel Aviv Stock Exchange (TASE), that could be because they aren’t well versed in the economic history of Israel that has made such opportunities possible. That was the contention of IIA President Brian Friedman during a recent event in Boston.

Israel is in the midst of an IPO boom just like the United States, particularly for technology companies. The biggest offerings still prefer a U.S. listing, but the Tel-Aviv Stock Exchange (TASE) is becoming increasingly attractive as well.

Investors today may be worried about inflation, but it may be wise to view today’s rising prices with some historical perspective. As it turned out, this economic crisis laid the foundation for Israel’s future success.

The Israeli economy is in the midst of a profound restructuring. It’s an exciting time for individuals and foundations to support Israel’s burgeoning success story while putting their assets to work in support of their own mission-driven goals and values.

Impact investing it’s a chance for mission-driven investors and foundations to see their money support sustainability goals encouraging companies to benefit communities and even globally.

With a strong startup ecosystem, active VC industry, & effective central bank, it makes sense Investing in Israel.

As Israel Investment Advisors (IIA) marks its 10th anniversary, it is worth recalling how the fund began.

Given the long-simmering financial revolution underway in Israel, we are confident IIA will grow substantially in the coming years. How will we get there?

Israel’s tech firms have given the country a reputation as the “Start-Up Nation.” But Israeli firms often have difficulty scaling up to the next level, largely because of illiquidity in the market.